In Part 1 of this “Intro to Credit Card Miles and Points” series, I provided an overview of the types of credit cards available and which work best for our needs. In Part 2, I’m going to help decipher the complicated earning and redemption rules that go along with each type of card and illustrate the wide range of rewards you can get from the same amout of spending. Note that we don’t get any kickbacks for the links below (I just like talking about what we’ve found that works for us).

Earning: Choosing and Using the Right Card(s) at the Right Time

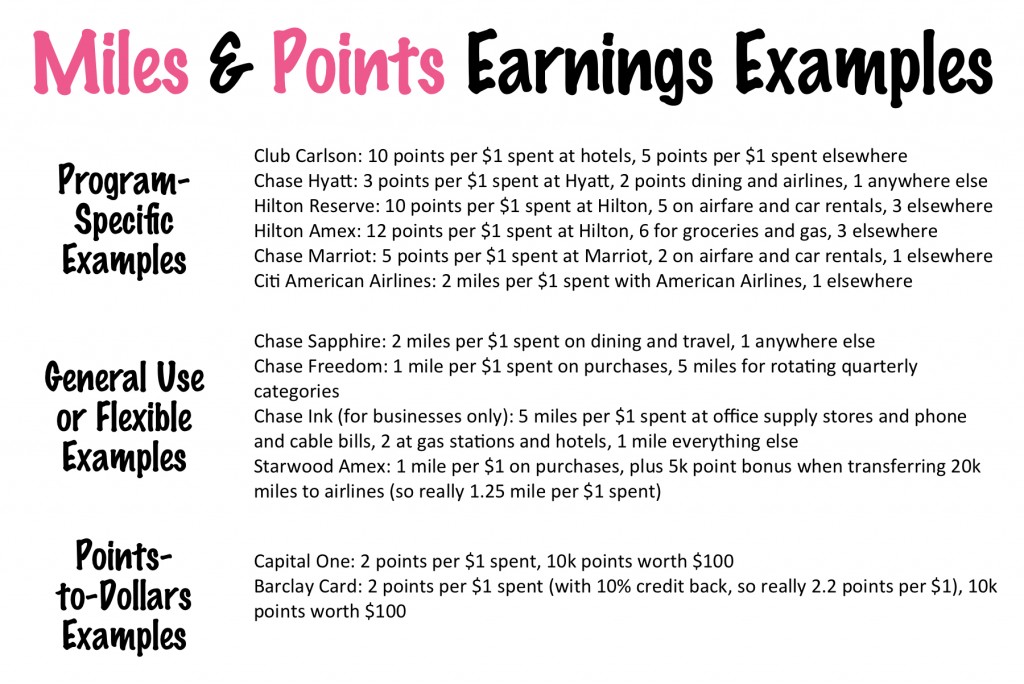

In general, I use the term miles for airline-related rewards and points for hotel-related rewards. For the most part, an airline mile is an airline mile as far as earning and redemption goes. But all hotel points are definitely not created equal, as we’ll see later on. To help understand this concept, we’ll use a few examples from each of the different types of cards outlined in Part 1.

The bottom line here is that one dollar of spending does not always equal one point. Of course there are nuances to what is listed above; for instance, some cards have foreign exchange fees (a concern if you are traveling internationally… though you can always build up your points balance stateside on the best card option—even if it has a fee—and do your international purchasing on a back-up card), while others don’t. Some have annual fees, which may or may not be worth the rewards (I’ll talk a little about this when I introduce our favorite card in a later post). So, are you confused yet? Well, unfortunately, it’s about to get worse. These complicated earning and redemption procedures are a huge reason why miles and points were the most asked about things once we announced our plans for extended travel, mostly on points.

Redeeming: Why All Points Aren’t Created Equal

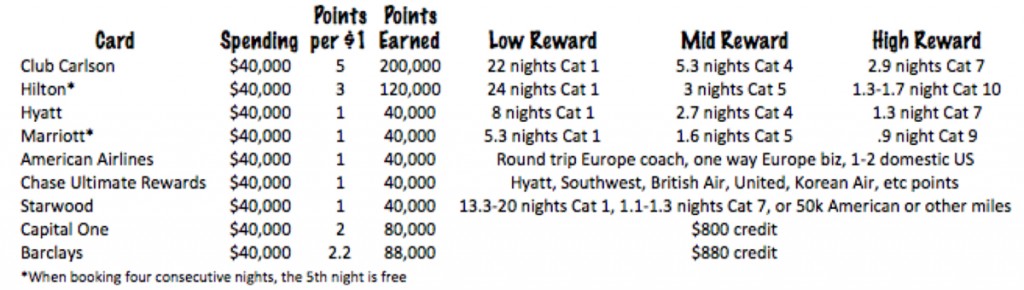

Looking just at the information above, you would think, “Club Carlson and Hilton give you way more points! Why would anyone get anything else?” Well, as it turns out, those credit cards usually award more points because it takes more points to get the same benefit. For instance, Club Carlson and Hilton rooms top out between 70,000 and 95,000 points a night, while Starwood, Marriott, and Hyatt top out between 30,000 and 45,000.

To make matters worse, hotel chains classify their properties in different ways. Given the range of points it requires to book a reward night, categories matter. Typically, higher category ratings signal pricier options. There are very few Category 1s in the United States, but often many extremely nice options abroad. This point is crucial to how we will be able to stay for weeks at a time on our hotel points balance. For instance, the New York Waldorf Astoria will run you 80,000 (or 190,000 for a luxury room) points a night. On the other hand, we’re directing our travel towards low-point but high-quality options like this and this.

Here’s a look at what each of these different cards could get you, assuming you spend $40,000 on your credit card.

As you can see, there is a wide range of possibilities. And, even though I tried my hardest, this table doesn’t give you a totally apples-to-apples comparison. You still have to take into consideration the availability of each type of rewards. For instance, it’s a good idea to ask yourself “Why does Marriott give away so many more free nights in Category 1 than Hilton? How many Category 1 properties do they have? Where are they located?” Over time you’ll learn which type of points generally make sense for you using factors like where you usually travel, whether you have preferences for certain chains over others, and how much lead time you typically have to book your trips. And if you want to go further down the hotel reward rabbit hole, this is a great place to go next.

Why We Choose Miles and Points over Cash Rewards Every Time

When I got my first credit card, I tried my best to find the card that would give me the most points per dollar I spent. I ended up getting the Capital One No Hassle credit card (it’s actually called a travel card), earning 2x points on dollars spent, and “purchased erased” any travel-related expenses on my monthly statement or sent myself some gift cards to fund my Starbucks habit. And this strategy worked great for me for a time and is often the best choice for folks who travel infrequently. For instance, we know a couple who earns exclusively cash back rewards and waits to redeem them until Christmastime, effectively “paying for” all their kids’ presents that year.

But, for us and I’d argue many people we know, choosing cash back rewards usually leaves a lot of value on the table. Here’s why: as you can see from the table above, $40,000 in spending can get you $800-$880 in cash rewards. Or, it could get you at least 40,000 miles. I say at least because the table above assumes only 1 point per dollar on all spending, even though (as we learned at the beginning of this article) many cards give you a bonus on categories like dining, travel, or groceries. Since we know which of our cards gives us bonuses when, in reality about 50% of our credit card spending is at the 2x or higher rate. So the 40,000 is actually more like 60,000. Are you with me so far? So, what would you rather have? $800-$880, or 60,000 miles?

I’d rather have 60,000 miles (or the equivalent number of hotel points) every time. Why? Well, those miles could translate into thousands of dollars in airline value: an international one-way first or business class ticket, at least one international round trip coach seat, or a couple domestic flights (though you definitely get the most value out of international trips). Or, with the equivalent number of hotel points, we will be able to stay for free for weeks in Category 1 rooms with certain hotel chains. Teaser alert: Chris and I have turned 60,000 miles each into tens of thousands of dollars in value, which we’ll talk about soon. I’d take that over 800 bucks any day.

Now that you have a sense of the miles and points landscape (and see the potential value you can get within it), are you interested in how to rack up value for spending you’re already doing? The last article in this series will outline our family’s best practices for maximizing the spending we’re already doing. So stay tuned, miles fans!

Great overview of the world of credit card rewards! I very much appreciate all the effort you took to pen the details. Thanks!